Trevor Maxwell

Translating Data To Insightful Stories

View My LinkedIn Profile

The advancement of AI piqued my interest. What started as an exploration of the emerging technology

turned into a career transition. I am excited to be working as a technical business analyst. I am

looking forward to what I will continue to learn and discover.

Drilling Down On IDA Loans.

Background

The data is a snapshot from the world bank for November 2022. We’re going to be analyzing it. More specifically the IDA statement of credits and grants. Then looking at helpful insights from the SQL inquiries.

The origin of the data can be found here

The International Development Association (IDA) credits are public and publicly guaranteed debt extended by the World Bank Group. IDA provides development credits, grants, and guarantees to its recipient member countries to help meet their development needs.

The Data

We started our journey by asking a few interesting questions!

- What is the highest loan to the IDA?

- Who has the most loans?

- Which was the most recent to pay?

Key Insights Questions

- What are the 5 countries with the most debt?

- Is the debt being utilized properly?

- Are there countries with no debt and who are they?

- Are there countries that need more money?

- Who is paying back most consistently?

- How is Nicaragua doing?

Let’s get into it!

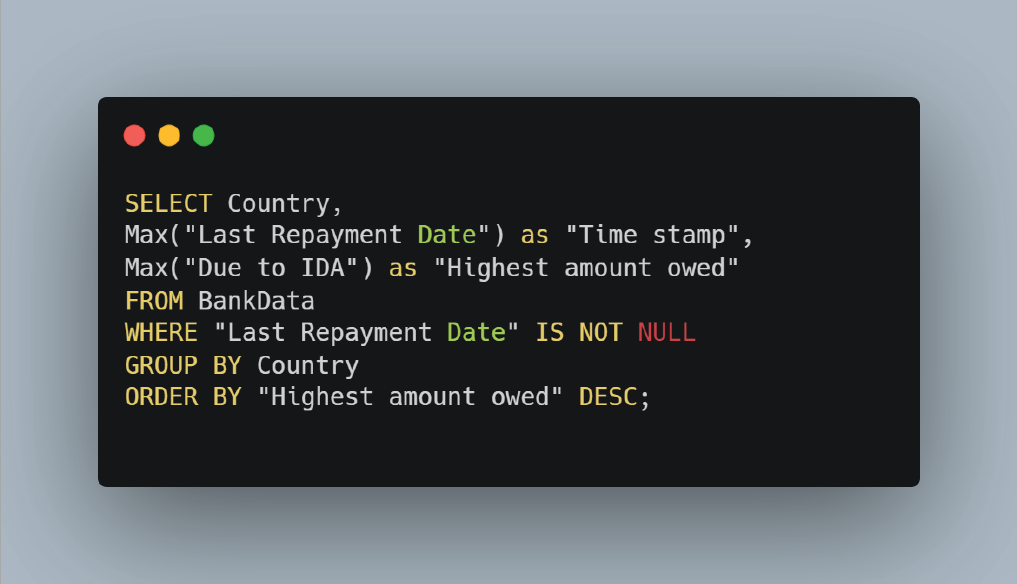

Want to guess what the answer is before I tell you what the database says?

India has both the most amount owed at $793,256,127.64

and the highest number of loans of 58,339

The curveball question was tricky though. The most recent country to pay was Tanzania.

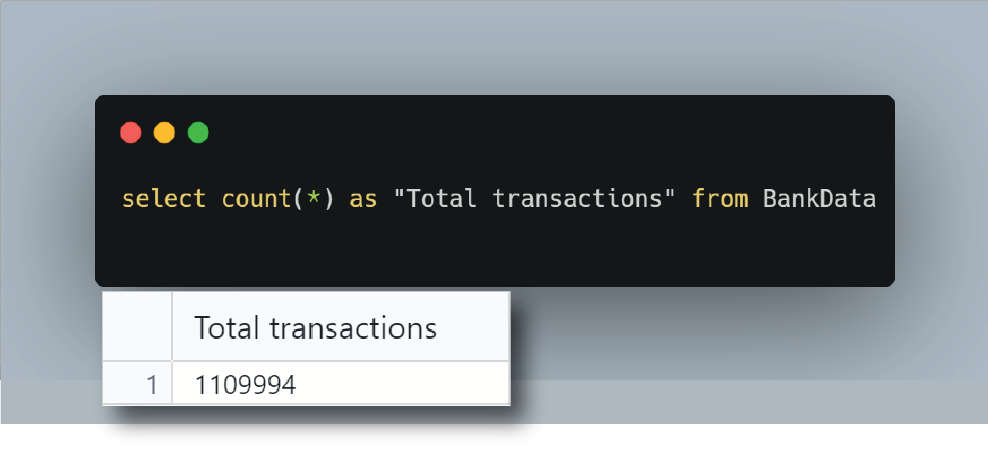

The next question we had was how much activity is going on in general. We looked at how many total transactions.

Looks like lots of activity that’s great to see. With 1’109’994 transactions currently recorded. What I see here is countries are actively investing in development and looking for ways to grow.

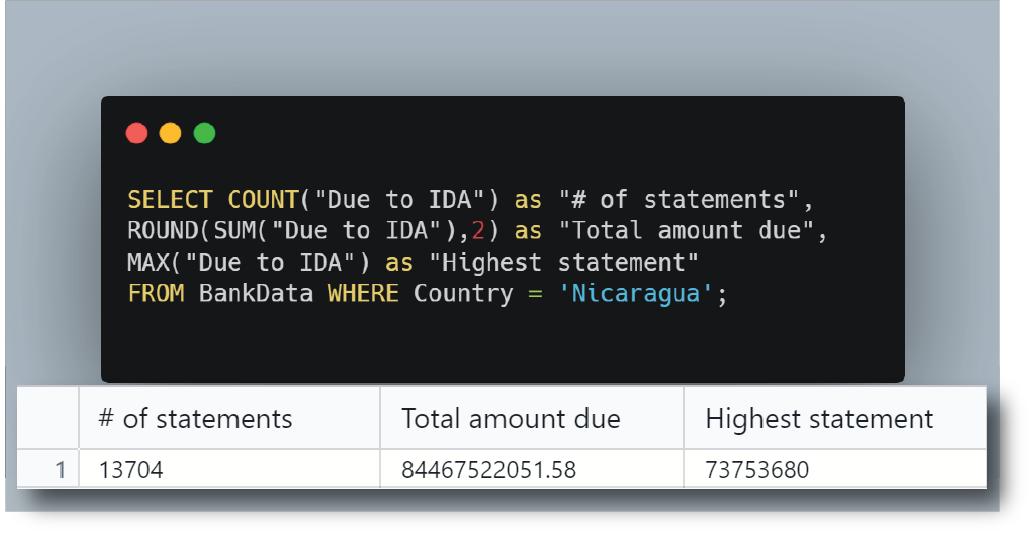

We were asked to get some details about Nicaragua and this is what we found.

The amount gets kind of crazy to think about. The SUM of all their loan amounts is almost $85 Billion! Is there a limit on how much can be owed? If not then there probably should be.

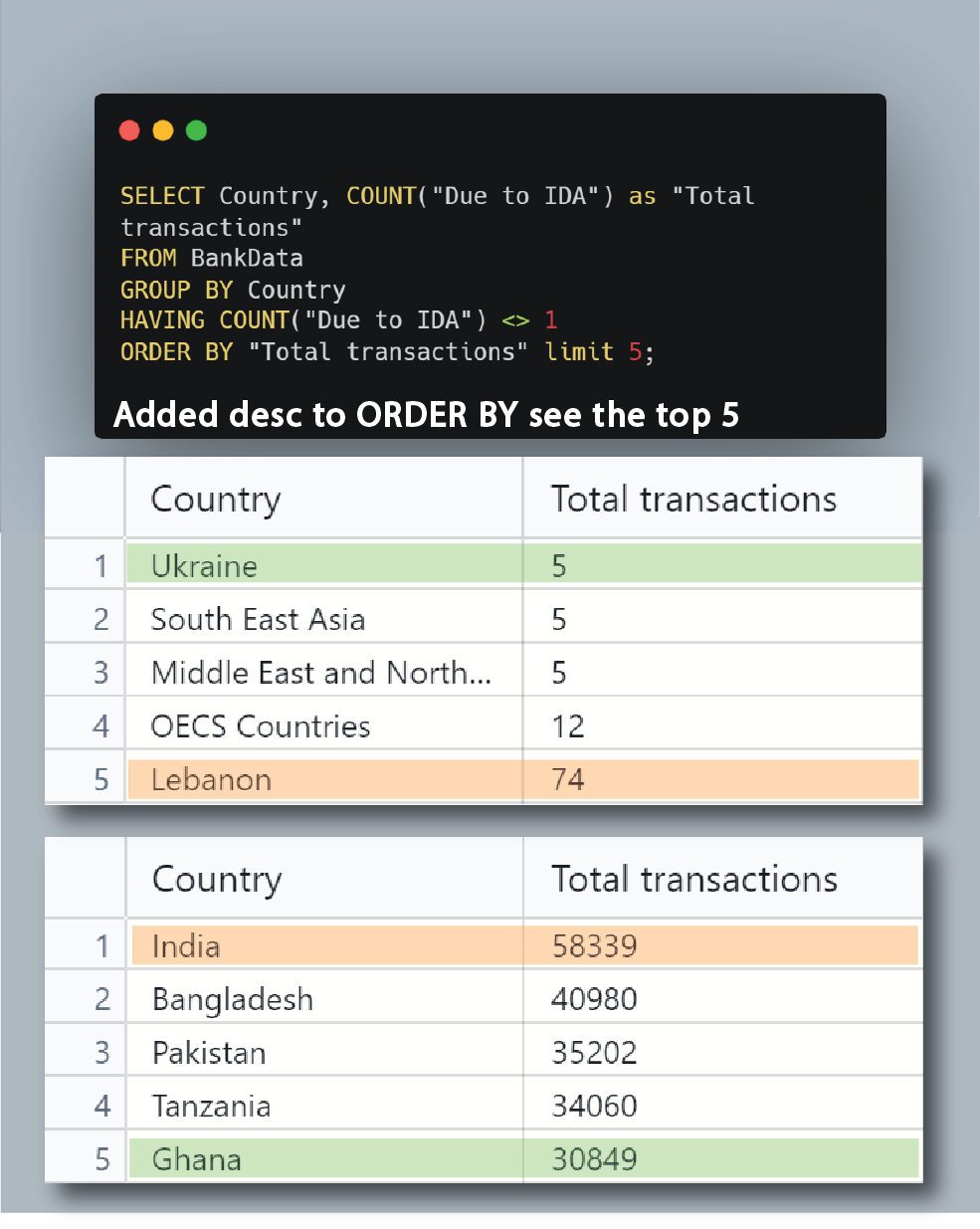

Now one of the most interesting inquiries was to group transactions by country. Let’s look at the top and bottom 5 for the transaction amount.

I learned here that Ukraine, South East Asia, and the Middle East are not using the IDA much at all. Two are clearly a category and should be broken up by country in more detail. We can see here as we learned before India has the most transaction

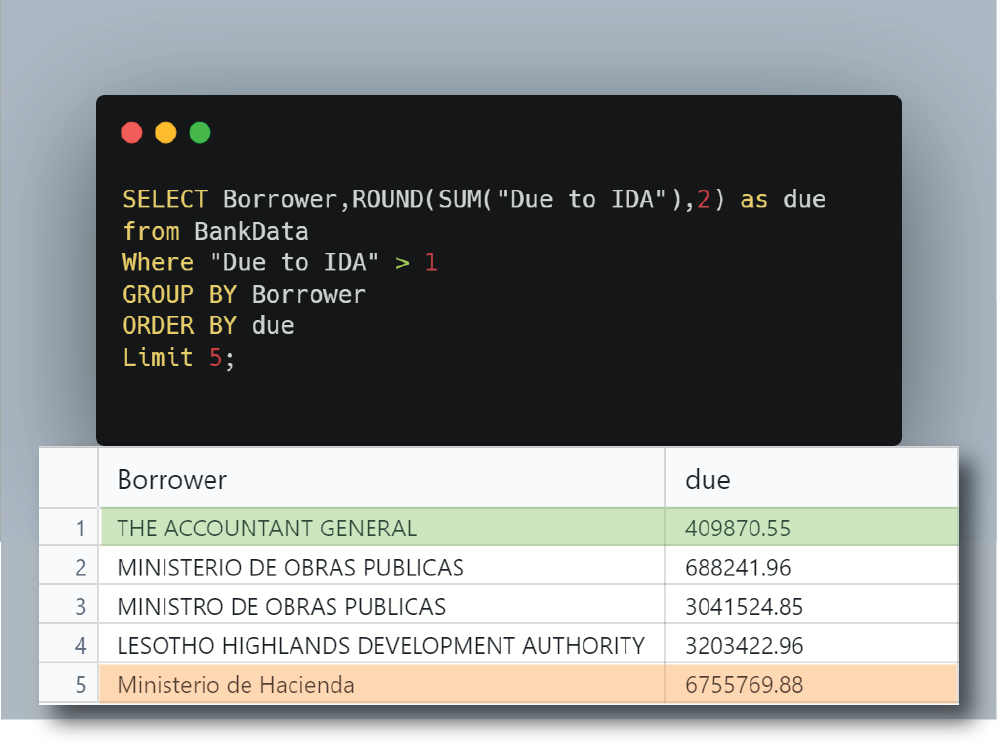

Lastly, we had one last question looking at the 5 lowest loan amounts by the borrower.

I learned from this that the amount of the lowest borrower and the highest is a huge difference. Looking at why the divergence to so large between borrowers is worth looking at more.

Key Insights

- Identified the top five countries with the most debt.

- Recommend checking if the top 5 are utilizing it for their development.

- Identified the 5 countries with almost zero debt to IDA.

- Recommend confirming if the bottom 5 need more resources.

- It would be good to have a look at who is paying back most consistently.

- We took a close look at Nicaragua specifically.

The divergence in the borrowers could be related to the rate of interest or return they are offered.

If you enjoyed reading this project, let’s connect on LinkedIn and check out some other projects I have done!